In a digital-first world where e-commerce, IOT, big data, and other fast-moving digital advances are increasingly up-ending traditional practices, certain businesses are turning to mergers and acquisitions (M&A) and corporate venturing to manage the market disruption brought about by innovation driven startups.

Futureproofing with Mergers and Acquisitions

While traditional mergers and acquisitions have been transactional and static, a more dynamic approach is now required if both the acquiring and acquired companies are to get the most from the partnership.

Whether they are sought for diversification or to enter new markets, M&As can enhance the capabilities of the acquiring company. The absorption of a business’s processes, infrastructure, people and culture can strengthen and future-proof the buyer’s operations against disruption while also promoting internal innovation.

All types of business, big or small, may seek out M&A opportunities. In fact, one esteemed client, a conglomerate of successful supermarkets and one of the largest retailers in the world, identified advantageous merger opportunities with two startup organizations.

The conglomerate was seeking to further consolidate their market position, enable the digitalization of parts of its operations, and encourage innovation by connecting with startups.

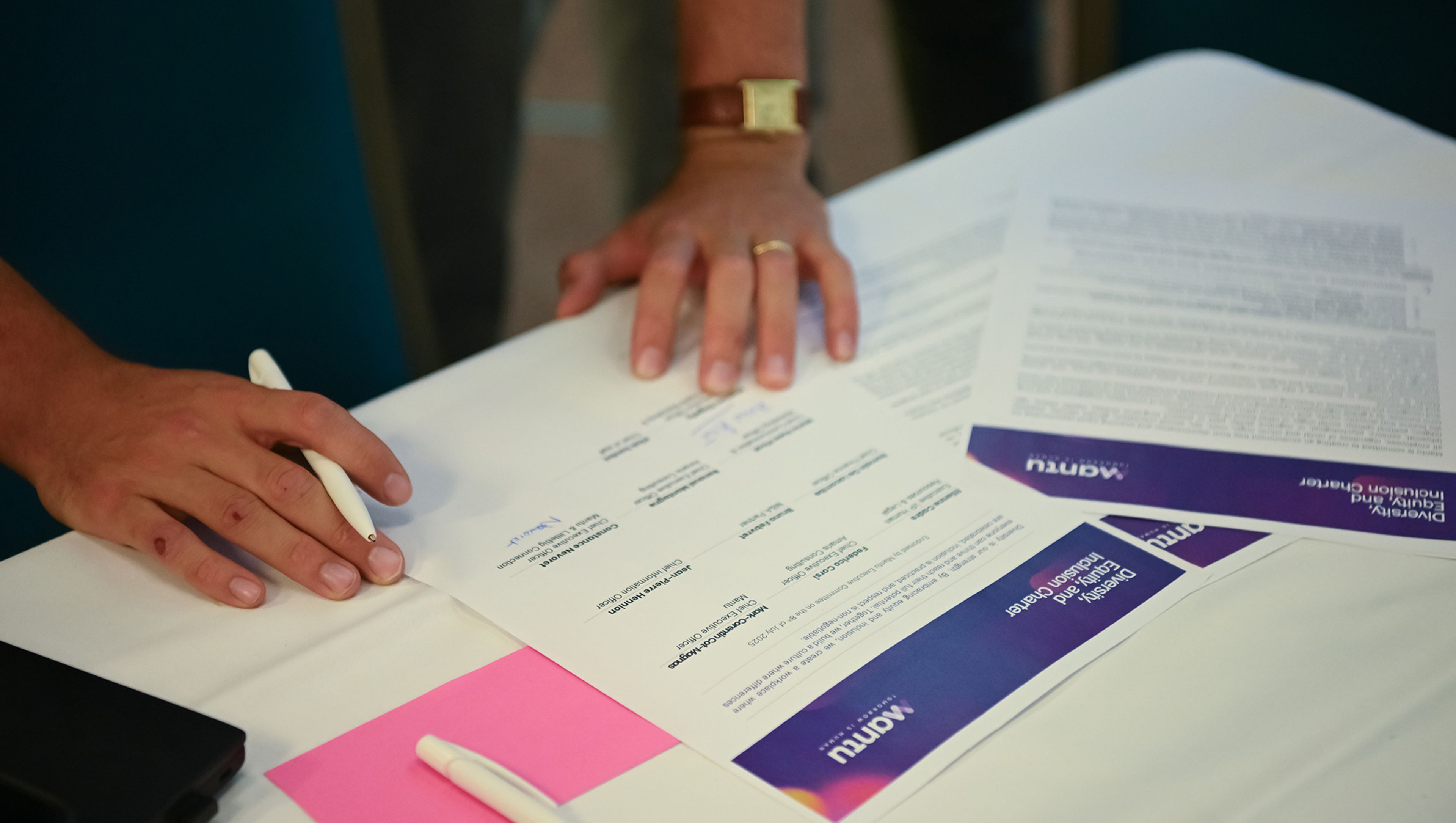

As this was a major opportunity for external growth, the client required guidance on how to approach the acquisition of new entities in terms of due diligence, structure, and the integration of the newly acquired businesses into its own organization. It reached out to Mantu brands Amaris Consulting and Pixel Alliance for support.

The client wished to preserve the integrity of the acquired business culture. Accordingly, integration rather than assimilation was identified as the key objective.

Successful mergers and acquisitions acknowledge and effectively manage the human aspect of their partnership. The client considered this to be a crucial factor in choosing the right partner: customer and employee expectations were high on its list of priorities, as was expanding its customer offering.

Incorporating elements of the acquired companies into its business would result in an enhanced level of service, but at the same time, special care had to be taken to ensure that the acquired businesses were well integrated in terms of workforce, process, and methodology.

Mantu’s brands had two key goals throughout this project. Firstly, to build a roadmap for the effective union of the companies in terms of startup culture, organization, operations, etc. Secondly, to manage how these factors would combine to redefine the future of all parties’ operations. In this case, it was key to enable the entrepreneurs behind the acquired startups to continue operating independently after the amalgamation, as was planning how to incorporate an innovative startup culture into the client’s large organization.

Mantu and all its brands have entrepreneurship in their DNA. The Mantu Group is a platform for entrepreneurs, and understand how intrinsic identity, autonomy, and founding purpose are to growth and success. The Mantu brands were thus able to support the full integration of these elements into the client’s union.

The client’s customers now have a significantly enhanced customer experience: they can access a much wider range of products and services due to the capabilities of the acquired companies. The partnership also increased operational capabilities and efficiencies.

By paying particular attention to the uniqueness and vision of the acquired entities, Amaris Consulting and Pixel Alliance were able to successfully integrate not only the acquired companies’ services but also their culture within their client’s existing structure.

The support and expertise of the Mantu brands’ financial experts created the necessary conditions for the long-term development and sustainability of the client’s operations following the project. Their focus and dedication to the alignment of all parties, the economical requirements, risk management, and the maintenance of an entrepreneurial ethos ensured the client was supported far beyond the classic M&A approach.